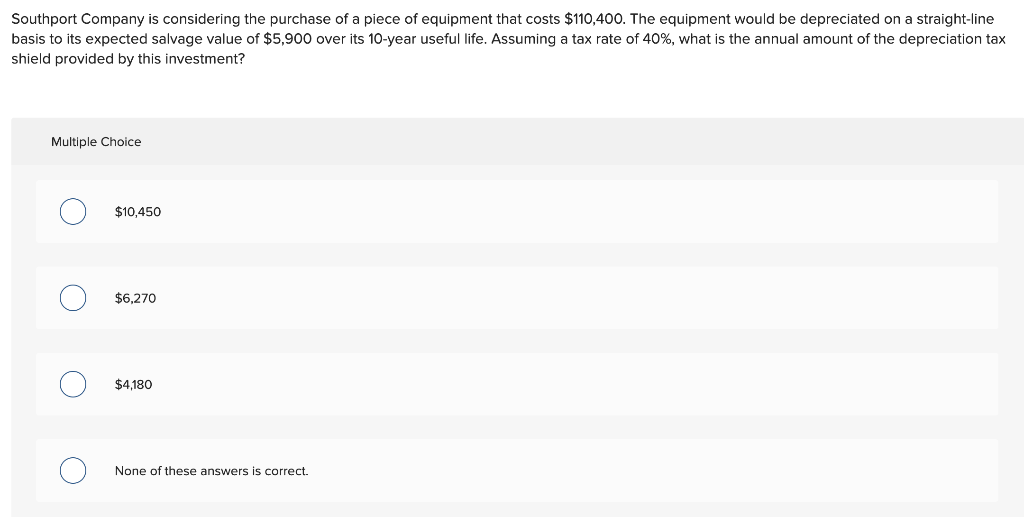

In the section below, we cover two of the most common methods and their Cash Flow and Valuation impacts. Below, we take a look at an example of how a change in the Depreciation method can have an impact on Cash Flow (and thus Valuation). As you can see from the above calculation, the Depreciation Tax Savings as the expense increases.

FAR CPA Practice Questions: Calculating Interest Expense for Notes Payable

A depreciation tax shield is a tax reduction technique under which depreciation expense is subtracted from taxable income. The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate, multiplied by the amount of depreciation. This tax shield can cause a substantial reduction in the amount of taxable income, so many organizations prefer to use accelerated depreciation to accelerate its effect. Accelerated deprecation charges the bulk of an asset’s cost to expense during the first half of its useful life.

Everything You Need To Master Financial Modeling

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. The Life of Solar Power Plant is considered as 25 Years, but in this example, we have considered the time period for 4 years only. In Case we don’t take the Depreciation into account, then the Total Tax to be paid by the company is 1381 Dollar.

The Financial Modeling Certification

On the income statement, depreciation reduces a company’s earning before taxes (EBT) and the total taxes owed for book purposes. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Or, the concept may be applicable but have less impact if accelerated depreciation is not allowed; in this case, straight-line depreciation is used to calculate the amount of allowable depreciation. Tax shields allow taxpayers to reduce the amount of taxes owed by lowering their taxable income. When filing your taxes, ensure you are taking these deductions so that you can save money when tax season arrives.

CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Therefore, the 1st option is better since it offers a lower cost of acquisition. The Depreciation Tax Benefit reflects the money saved on Income Taxes due to Depreciation Expense. To wrap this up, we hope you now have a much better understanding of the Depreciation Tax Shield Calculation as well as the underlying concept.

Understanding a Tax Shield

For example, if a company has cash inflows of USD 20 million, cash outflows of USD 12 million, its net cash flows before taxation work out to USD 8 million. If the tax rate is 33%, the company’s tax liability works out to USD 1 million (USD 3 million × 33%) which equals after-tax net cash flows of USD 7 million (USD 8 million – USD 1 million). Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income and can be calculated by multiplying the tax rate with the depreciation expense. Companies using accelerated depreciation methods (higher depreciation in initial years) are able to save more taxes due to higher value of tax shield. The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses.

Beyond Depreciation Expense, any tax-deductible expense creates a tax shield. Here, we explain the concept along with its formula, how to calculate it, examples, and benefits. You may also look into the related articles below for a better understanding. ABC Ltd. is considering a proposal to acquire a machine costing $ 1,10,000 payable $ 10,000 down and balance payable in 10 equal installments at the end of each year inclusive of interest chargeable at 15 %. Another option is to acquire the asset on a lease rental of $ 25,000 per annum payable at the end of each year for 10 years.

- The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth.

- A depreciation tax shield is a tax reduction technique under which depreciation expenses are subtracted from taxable income.

- On the income statement, depreciation reduces a company’s earning before taxes (EBT) and the total taxes owed for book purposes.

- A 25 % depreciation for plant and machinery is available on accelerated depreciation basis as Income tax exemption.

- A company is reviewing an investment proposal in a project involving a capital outlay of $90,00,000 in a plant and machinery.

- For example, because interest payments on certain debts are a tax-deductible expense, taking on qualifying debts can act as tax shields.

When adding back a tax shield for certain formulas, such as free cash flow, it may not be as simple as adding back the full value of the tax shield. Instead, you should add back the original expense multiplied by one minus the tax rate. This is because the net effect of losing a tax shield is losing the value of the tax shield but gaining back the original expense as income. In order to calculate the depreciation tax shield, the first step is to find a company’s depreciation expense.

Based on the information, do the calculation of the tax shield enjoyed by the company. Suppose we are looking at a company under two different scenarios, where the only difference is the depreciation expense. As you can see above, taxes are $20 without Depreciation vs. $16 with a Depreciation deduction, for a total cash savings of $4. Also, at higher tax rates, Depreciation is going to provide additional savings. When it comes to understanding the tax shield definition, understanding how to calculate it under different scenarios is important.

This machinery has an estimated useful life of 10 years and a salvage value of $10,000. In this case, the tax shield would amount to $25,000, meaning the business would save $25,000 in taxes due to the deductions or credits it has utilized. The recognition of depreciation causes a reduction to the pre-tax income (or earnings before how much will property taxes go up for adding a bedroom taxes, “EBT”) for each period, thereby effectively creating a tax benefit. The Depreciation Tax Shield refers to the tax savings caused from recording depreciation expense. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield.